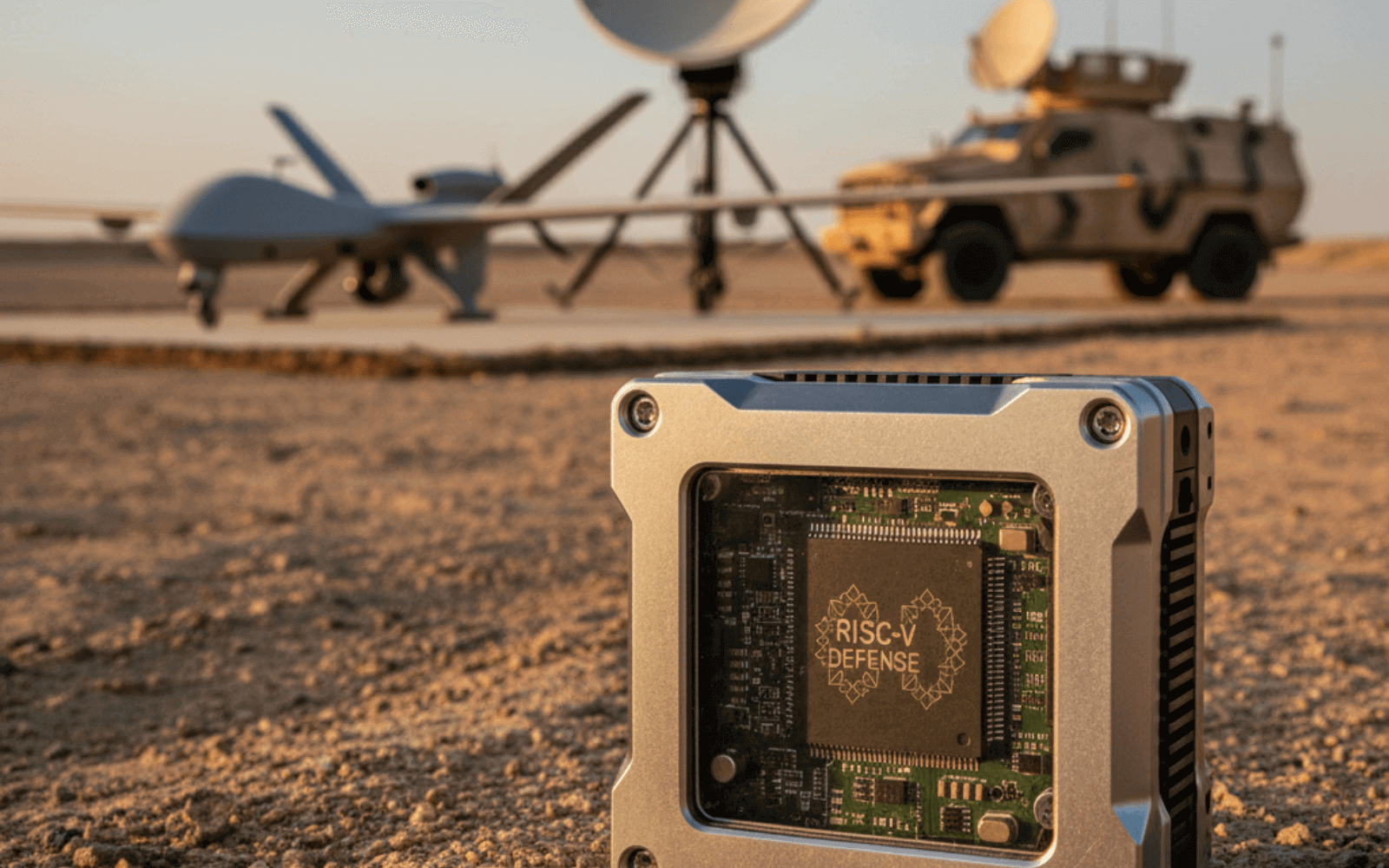

To market RISC-V cores to UAE defense contractors, you need to position them as sovereign, resilient, AI-native building blocks that directly support the UAE’s defense vision, rather than just “another open CPU option.”

In the high-stakes arena of global defense technology—where great-power competition, export controls, and supply-chain shocks are the norm—the UAE is positioning itself as a serious hub for sovereign, AI-ready defense systems. As of 2025, the UAE’s defense market is estimated at around USD 23–24 billion in annual spending, with a clear focus on localization, advanced electronics, and autonomy.

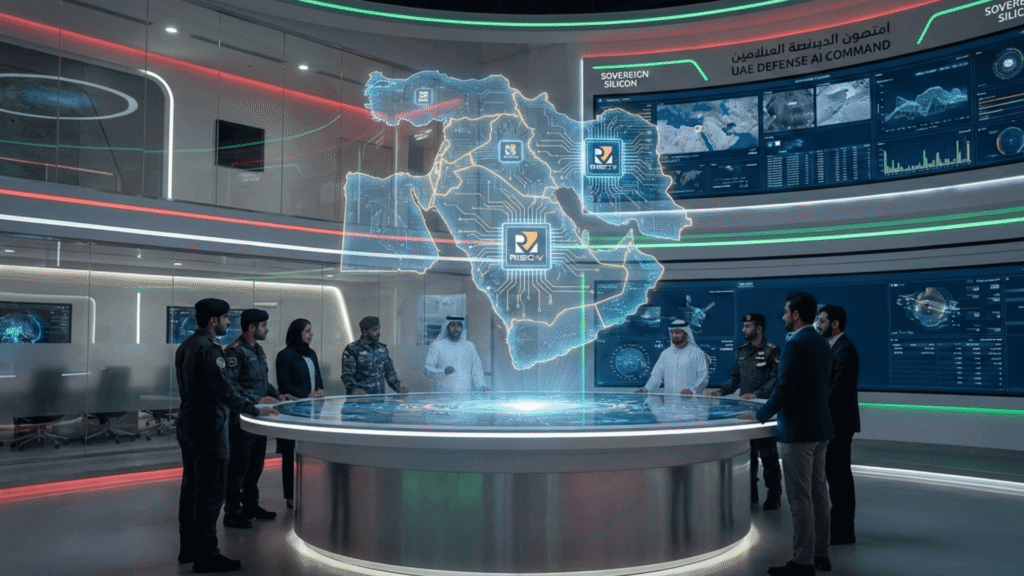

Now zoom in from the global picture to a UAE defense lab: leaders are asking the same question: Why rely on foreign black-box chips when we can control our own silicon? RISC-V answers that question with technology the UAE can shape, secure, and scale.

This guide shows you how to tell that story—clearly and convincingly—to Tawazun Council, EDGE subsidiaries, and international primes operating in the Emirates.

1. Why Does RISC-V Resonate with the UAE’s Defense Vision?

RISC-V began as an academic project at UC Berkeley and has grown into a global, open ISA ecosystem used by thousands of companies. Unlike proprietary ISAs such as ARM or x86, RISC-V offers royalty-free licensing and extensibility, allowing designers to add custom instructions and security features without negotiating per-core fees.

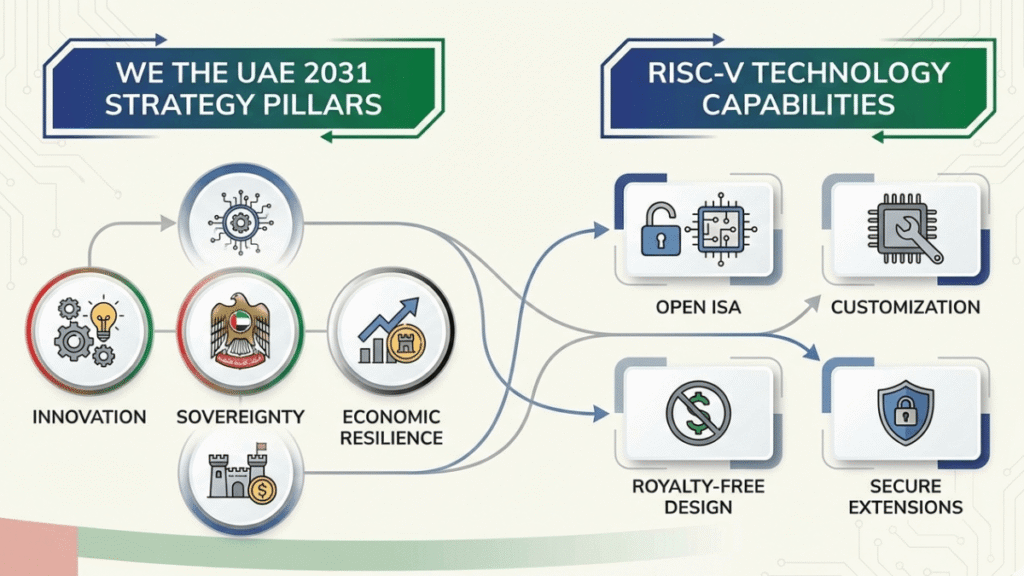

This flexibility dovetails with the UAE’s long-term national goals:

- “We the UAE 2031” targets roughly AED 3 trillion in GDP by 2031, with a strong emphasis on innovation, advanced industry, and reduced external dependency.

- The National AI Strategy 2031 projects AI to contribute around AED 335 billion to the national economy by 2031, including in defense, space, and critical infrastructure.

From a positioning standpoint, you are not just “selling a CPU core.” You are aligning RISC-V with three macro-messages UAE defense stakeholders care about:

- Technological sovereignty – freedom from single-vendor lock-in and politically exposed IP.

- Configurable performance – the ability to tailor cores for specific defense workloads (drones, EW, ISR, C4ISR, etc.).

- Economic efficiency – redirecting license fees and premium margins into local R&D and localization programs.

Global RISC-V shipments have crossed the tens of billions of cores, with especially fast growth in embedded and edge devices. That gives you a credibility base: RISC-V is no longer an “experiment”—it’s a mainstream option with serious ecosystem weight.

How to use this in a pitch

- Open with UAE strategy language, not architecture jargon.

- Show how RISC-V supports “Made in UAE” electronics, secure autonomy, and AI-enabled defense platforms.

- Use simple visuals: a one-page slide mapping RISC-V advantages to We the UAE 2031 pillars and defense localization goals.

2. How Can You Turn the Global Chip Shortage into a RISC-V Narrative?

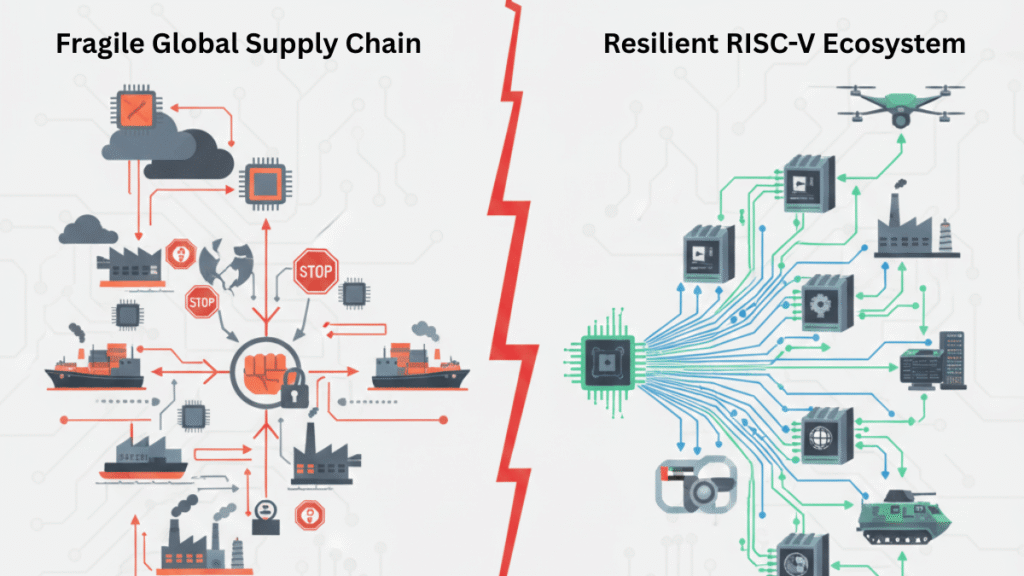

The post-2020 semiconductor environment has shown how fragile global supply chains can be. Long lead times, geopolitical export controls, and over-reliance on a small number of advanced fabs (especially in East Asia) have affected sectors from automotive to defense.

For UAE defense contractors, this translates into:

- Longer lead times for proprietary CPUs and SoCs, particularly those tied to export-controlled markets.

- Pricing volatility and schedule risk on programs that depend on a single vendor or single geography.

- Strategic concern: what happens to national capabilities if one or two suppliers abruptly become unavailable?

RISC-V gives you a compelling supply-chain story:

- Multi-fab flexibility – Designs can be implemented at different foundries (e.g., TSMC, GlobalFoundries, Samsung, Intel Foundry Services), reducing single-point risk.

- Open ecosystem – A growing set of IP vendors, toolchains, and design houses means no dependence on a single proprietary roadmap.

- Fabless-friendly – UAE entities can operate as fabless design houses, keep IP local, and leverage global manufacturing capacity.

When you talk about the “world short computer chips ARM RISC-V” narrative, avoid hard numbers unless you have a concrete source. Instead, emphasize:

“In a world where advanced chips can face 20–30+ week lead times and export-control uncertainty, vendor-neutral architectures like RISC-V give the UAE more options for both procurement and contingency planning.”

Tactical marketing moves

- Run webinars or closed-door briefings for Tawazun-linked stakeholders modelling “what happens to program timelines if one supplier is unavailable—and how a RISC-V-based, multi-fab strategy changes that curve.”

- Use scenarios, not fear: frame RISC-V as a resilience tool, not a panic button.

3. What Role Does AI Play in the RISC-V Story for UAE Defense?

The UAE is investing heavily in AI infrastructure and capabilities—from national AI strategies to large-scale compute projects such as Stargate UAE, a planned multi-GW AI campus developed with partners like G42, OpenAI, Nvidia, Cisco, and others.

At the same time, startups like Mastiska are working on sovereign AI accelerators and RISC-V–based inference chips tailored to regional needs.

For defense audiences, that means:

- AI is no longer a “nice-to-have”; it is embedded in ISR, electronic warfare, autonomous systems, and decision-support.

- Edge AI—on drones, vehicles, ships, and remote sensors—is becoming as important as data-center AI.

RISC-V plays naturally in this space:

- Vector and DSP extensions support efficient ML inference at the edge.

- Custom instructions can accelerate specific defense workloads (e.g., radar signal processing, sensor fusion, crypto).

- Open hardware plus domain-specific accelerators enables “fit-for-mission” silicon rather than generic CPUs.

How to market this

- Position RISC-V as the “AI-native” ISA for edge defense, complementing—not replacing—big GPU clusters in national AI centers.

- Develop Arabic and English whitepapers on: “RISC-V for Edge AI in ISR and Autonomy,” tailored to UAE use cases (border surveillance, coastal monitoring, counter-UAS, predictive maintenance on platforms, etc.).

- Use the phrase “market RISC-V UAE defense” strategically in SEO copy, but in the article itself, keep the tone senior and solution-oriented.

Example use cases to highlight (without over-claiming numbers):

- Persistent ISR drones using RISC-V-based edge AI to reduce data uplink requirements and improve on-board decision-making.

- Autonomous navigation for ground or surface vehicles where low-power, high-reliability compute is critical.

- Predictive maintenance for radars and communications systems using local AI inference to flag anomalies before failure.

- Secure mission communications where crypto and AI-driven anomaly detection run on the same RISC-V SoC.

Each of these can be turned into a mini case-study or concept demo at events such as IDEX or Dubai Airshow.

4. How Can Fabless RISC-V Compete with Intel and AMD in UAE Bids?

You don’t need to attack Intel or AMD; they will remain dominant in many data-center and legacy workloads. The smarter play is to:

- Segment the battlefield: show where x86 is over-kill or over-priced (deeply embedded, SWaP-constrained, long-lifecycle defense platforms).

- Emphasize that RISC-V + a fabless model is about complementing existing stacks with sovereign, specialized compute.

A typical message for UAE defense RFPs could be:

“By using RISC-V as the core ISA in a fabless design model, UAE entities retain architectural control, avoid per-core royalties, and can co-develop mission-specific accelerators with local partners—while still leveraging Tier-1 global fabs for manufacturing.”

Concrete points to highlight:

- Cost structure: RISC-V eliminates ISA licensing fees and allows more capital to be allocated to local design, testing, and integration.

- Time-to-silicon: modern design flows plus mature foundry ecosystems make 18–24-month cycles from IP definition to first silicon realistic for focused SoCs, especially when reusing existing RISC-V IP cores.

- Alignment with UAE industrial policy: co-development with local universities, research institutes, and design houses builds national capability over time.

“For a detailed breakdown of how to structure a UAE-centric fabless program—from architectural definition to tape-out and bring-up—see our ‘UAE Fabless Guide: From IP to First Silicon in 18 Months’.”

Sales toolkit ideas

- An ROI calculator slide comparing lifetime costs of a proprietary SoC vs. a RISC-V-based fabless design including NRE, licensing, and long-term sustainment.

- A “sovereignty audit” checklist mapping where IP, data, and supply-chain dependencies sit in each option.

- FPGA-based demos that let UAE evaluators see RISC-V-based concepts in action before committing to silicon.

5. How Can Cybersecurity and Compliance Differentiate Your RISC-V Offering?

Cybersecurity is now a board-level and national-security issue in the UAE, with entities like the UAE Cyber Security Council issuing frameworks and guidance for critical sectors. At the same time, laws such as the UAE’s Personal Data Protection Law (PDPL) set expectations around data handling and auditability.

RISC-V gives you some useful talking points here:

- Transparency – The open ISA specification and growing ecosystem of open-source cores make it easier to inspect and reason about the hardware behavior, compared to entirely closed black-box designs.

- Custom security extensions – You can implement hardware root-of-trust, secure boot, isolation, and even experiment with post-quantum crypto accelerators directly at the ISA or micro-architectural level.

- Localization of sensitive IP – Security-critical parts of the design (e.g., key management, secure enclaves) can be developed and maintained within the UAE, even if manufacturing remains offshore.

In your marketing content, avoid claiming “X% fewer breaches” unless you have a published study. Instead, anchor the message like this:

“RISC-V provides a programmable security canvas: UAE defense primes can define and verify their own trusted execution environments and hardware root-of-trust mechanisms, rather than relying solely on vendor-defined features.”

Pair this with:

- Diagrams showing secure boot chains and isolation domains on a RISC-V-based SoC.

- References to emerging work on zero-trust architectures for hardware in research institutes and defense labs.

6. How Do You Build Long-Term Partnerships with UAE Defense Stakeholders?

Finally, marketing RISC-V to UAE defense contractors is not a one-off brochure exercise. It’s a relationship game.

A consulting-style engagement model might look like this:

Phase 1 – Strategic Alignment (Weeks 1–4)

- Stakeholder mapping: Tawazun Council, EDGE Group subsidiaries, local systems integrators, relevant ministries.

- C-level briefings on sovereignty, AI, and supply-chain resilience with RISC-V as an enabler, not the hero.

- Outcome: 3–5 qualified conversations where RISC-V is on the roadmap as an option.

Phase 2 – Technical Validation (Weeks 5–12)

- FPGA or emulation-based prototypes for a specific use case (e.g., UAV control computer, secure gateway, or sensor processing module).

- Joint workshops with engineering and cyber teams to assess toolchains, verification, and integration complexity.

- Outcome: agreement on a pilot or concept demonstrator.

Phase 3 – Co-Development and Localization (Months 3–12)

- Formalize a co-development program: RISC-V IP provider + UAE contractor + local research partner.

- Define IP boundaries, export-control considerations, and PDPL-aligned data flows.

- Outcome: a clear roadmap from prototype to production, including training and knowledge transfer.

Phase 4 – Scale and Ecosystem Building (Year 2+)

- Expand from one platform to a portfolio of RISC-V–based designs across land, air, sea, and cyber domains.

- Engage universities and technical institutes to build a pipeline of “FPGA dev grads AI RISC-V” talent.

- Outcome: RISC-V becomes a recognized, supported option in UAE defense RFPs and doctrines.

Throughout this journey, your content—articles, whitepapers, webinars—should feel less like vendor marketing and more like defense-industry thought leadership: grounded in UAE policy, realistic about risks, and explicit about where RISC-V fits and where it doesn’t.

Conclusion: How Do You Sell RISC-V as Sovereign, Not Just “Open”?

If you strip it down, the most effective way to market RISC-V cores to UAE defense contractors is to stop talking primarily about cores—and start talking about control:

- Control over architecture and IP (sovereignty).

- Control over supply-chain options (resilience).

- Control over AI workloads and security properties (mission advantage).

Link those themes to recognizable programs, events (IDEX, Dubai Airshow, GITEX), and strategies (We the UAE 2031, National AI Strategy 2031).

Do that consistently—in presentations, RFP responses, and thought-leadership content—and RISC-V stops being “just another ISA.” It becomes a strategic instrument in how the UAE designs, secures, and sustains its next generation of defense capabilities.